|

|

Accumulation/Distribution Line A momentum indicator that relates price changes with volume on the assumption that the more significant the volume, the more significant the price move. The Accumulation/Distribution Line has been one of the most popular volume indicators over the years . volume precedes price. Volume reflects the amount of shares traded in a particular stock, and is a direct reflection of the money flowing into and out of a stock. The Accumulation/Distribution Line was developed by Marc Chaikin to assess the cumulative flow of money into and out of a security. It is a momentum indicator which takes into account changes in price and volume together. The idea is that a change in price coupled with an increase in volume may help to confirm market momentum in the direction of the price move. Accumulation/Distribution Line formula A portion of daily volume is added or subtracted from a cumulative total. More volume is added the nearer the close to the high for the day and more subtracted the nearer the close to the low. Nothing is added or subtracted when the close is equidistant between the day's high and low. The Accumulation/Distribution Line formula is as follows: Acc/Dist = ((Close - Low) - (High - Close)) / (High - Low) * Period's volume Bullish Signals Positive Divergence A bullish signal is given when the Accumulation/Distribution Line forms a positive divergence, which means that the A/D line is trending upward while the price is trending downward. For example, if the accumulation/distribution line is moving up and the price of the stock is falling then the price is likely to reverse. Moving up When the accumulation/distribution line is moving up it depicts buying (accumulation), which should eventually lead to price increases. In an advance, the Accumulation/Distribution Line should keep up or, move in an uptrend.

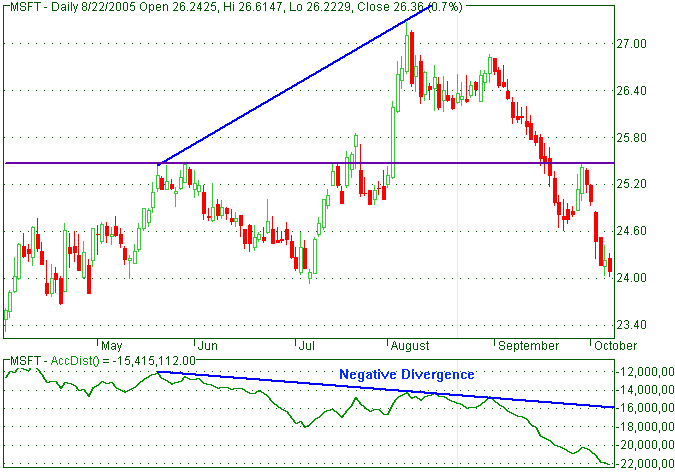

Bearish Signals Negative divergence A bearish signal is given when the Accumulation/Distribution Line forms a negative divergence, which means that the A/D line is trending downward while the price is trending upward. For example, if the accumulation/distribution line is moving down and the price of the stock is rising then the price is likely to reverse. Moving down When the accumulation/distribution line is moving down it depicts selling (distribution), which should eventually lead to price decreases. In a decline, the Accumulation/Distribution Line should keep down or, move in a downtrend.

|

|

|