|

On-balance volume

On-balance volume (OBV) is a technical analysis indicator intended to

relate price and volume in the stock market. OBV is based on a cumulative

total volume. Volume on an up day (close higher than previous close) is

added and volume on a down day is subtracted.

The technique was investigated in the 1940s

by Woods and Vignolia and presented in a course by them in 1946. They called

it "cumulative volume". Joseph Granville gave it the name "on-balance

volume" and popularized the technique in his 1963 book Granville's New Key

to Stock Market Profits. It can be applied to stocks individually based upon

their daily up or down close, or the market as a whole using breadth of

market data, i.e. the advance/decline ratio.

Calculation

As stated above, OBV is calculated by adding

the day's volume to a running cumulative total when the security's price

closes up, and subtracts the volume when it closes down.

For example, if today the closing price is greater than yesterday's closing

price, then the new

OBV = Yesterday's OBV + Today's Volume

If today the closing price is less than yesterday's closing price, then the

new

OBV = Yesterday's OBV - Today's Volume

If today the closing price is equal to yesterday's closing price, then the

new

OBV = Yesterday's OBV

The starting point for an OBV total, ie. the zero point, is arbitrary. Only

the shape of the resulting indicator is used, not the actual level of the

total.

How To Use

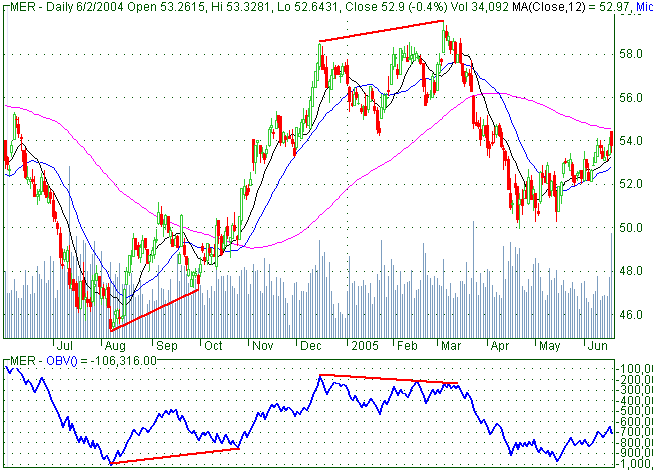

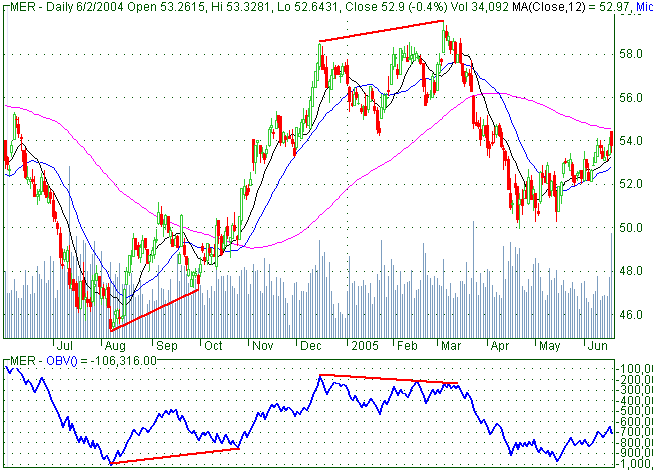

OBV is generally used to confirm price moves. The idea is that volume is

higher on days where the price move is in the dominant direction, for

example in a strong uptrend more volume on up days than down days.

So when prices are going up, OBV should be going up too, and when prices

make a new rally high, OBV should too. If OBV fails to go past its previous

rally high then this is a negative divergence, suggesting a weak move.

|

Accumulation Distribution

Bollinger Bands

Commodity Channel Index

Momentum

Money Flow

Moving Average

On Balance Volume

Parabolic SAR

Relative Strength Index

Stochastic oscillator

Support and Resistance

The Elliott wave principle

Trend Lines

Triple Exponential Average

Volume At Price

|